Have you ever looked at a freight quote and wondered about all the invisible forces that shape that number? While fuel and capacity get a lot of attention, one of the biggest drivers of cost and complexity in 2025 is something decided hundreds of miles away in government buildings: tariffs.

Simply put, tariffs are taxes on imported goods. While the importer pays them upfront, those costs always find their way to the consumer. Today, tariffs are a primary tool of trade policy, creating waves of economic uncertainty. Since trucking is the lifeblood of the North American supply chain, moving 85% of surface trade with Mexico and 67% with Canada according to Fleet-Connection.com, every policy shift directly impacts your business. This article explains the impact of tariffs on the trucking industry and how these unpredictable policies are changing the world of freight transportation services.

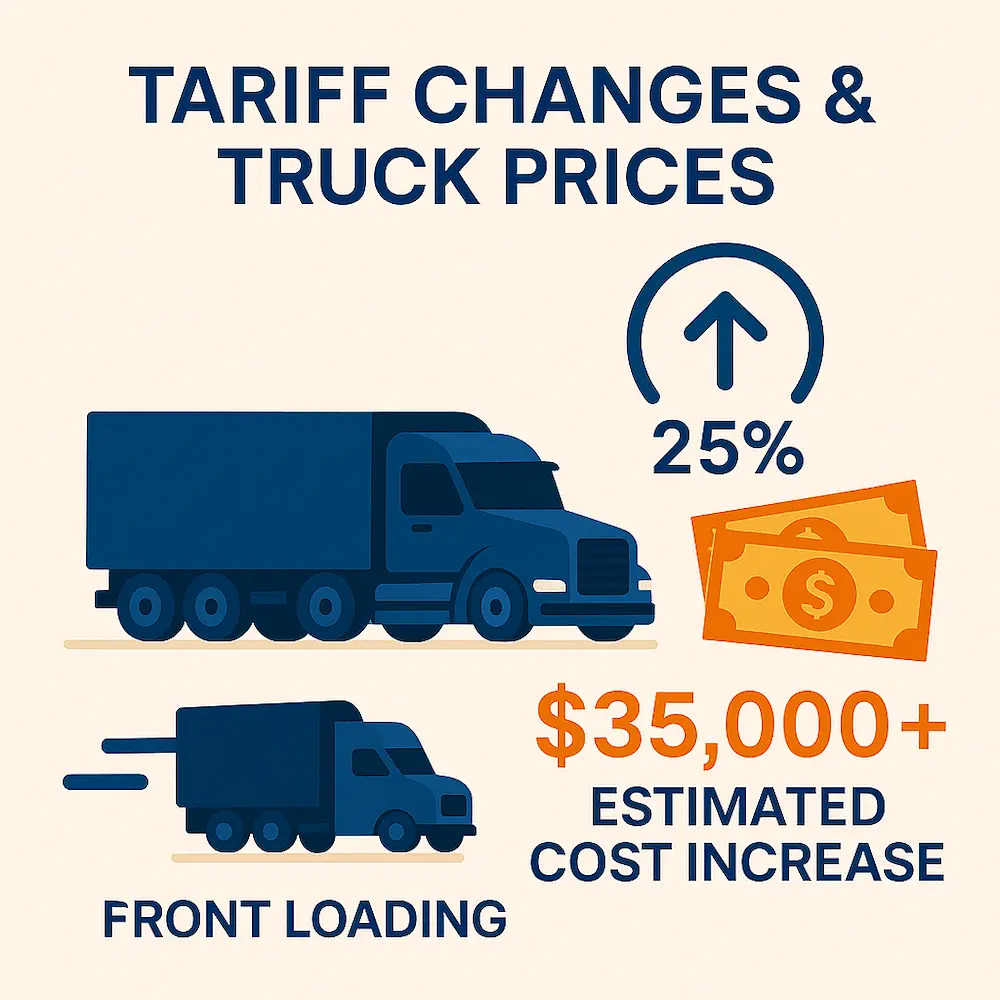

Tariff Changes and Truck Prices

The immediate tangible effect of tariffs is seen on the most critical asset of the industry— trucks. This means the very first impact of tariffs is felt significantly on the truck prices.

Impact on Equipment Costs and Pricing

As reported by CDK Global Heavy Truck, many heavy trucks assembled in the U.S. depend on parts from Canada and Mexico, with over 40% of all Class 8 trucks sold here being imported. A proposed 25% tariff could increase the cost of a new truck by about $35,000. S&P Global Mobility estimates this could lead to a 9% price hike for medium and heavy-duty trucks, potentially slashing demand in 2025 by as much as 17%.

Regional Variation and Canadian/Mexican Impact

The fallout from these policies isn’t the same everywhere. S&P Global Mobility forecasts that while U.S. truck registrations will actually climb 11% in 2025, the picture is different for our neighbors. Canadian demand is expected to fall by 3%, and Mexican demand is projected to plummet by 26%. This regional data highlights how Canadian trucking companies are impacted by tariffs.

Tariffs and Freight Pricing

Understanding the full tariff impact on trucking is crucial for budgeting and planning, as these broad economic policies translate directly to the rates you see on an invoice.

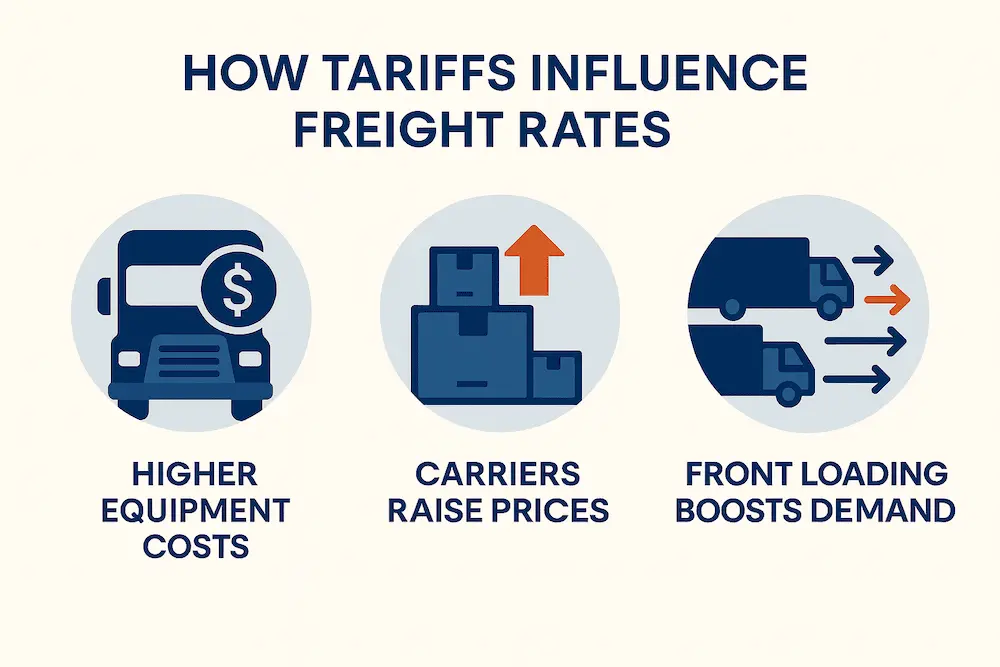

How Tariffs Influence Freight Rates

The connection between tariffs and freight rates can be complex. The most direct impact is cost pass-through. When trucks and parts become expensive, carriers must raise their rates to remain profitable. A 25% tariff on imports from Mexico could add tens of millions of dollars in annual costs for a large fleet, as cited by Fleet-Connection.com.

We also observe a phenomenon known as “front loading.” When companies realize that a tariff is coming, they rush to import goods before it comes into effect. This creates a temporary surge in freight volume and rates. But once the tariff seizes to its place, demand can fall off a cliff as businesses use up their stockpiled inventory. This leaves too many trucks chasing too little freight, putting downward pressure on rates.

Broader Economic Volatility

Beyond the direct costs, policy uncertainty itself creates market volatility. Shifting government priorities can influence everything from consumer spending to industrial production, which directly impacts truckload demand. When consumers and businesses are nervous about potential price hikes from tariffs, they spend less, especially on big-ticket items.

This uncertainty often pushes shippers toward the spot market. When they need to move freight quickly to beat a new tariff, they rely on spot capacity. This can cause spot rates to climb even when contract rates are staying flat, creating a confusing and unpredictable pricing environment for everyone.

Tariffs and Freight Lane Selection

The trucking tariff impact goes beyond just the price; it fundamentally alters the map of how goods move across the continent, affecting everything from drainage to long-haul routes.

Changing Trade Flows and Route Optimization

Tariffs don’t just change prices; they change the very routes that goods travel. A new tariff can cause a sudden spike or drop in demand on specific lanes, forcing carriers to reevaluate their entire network. This might mean higher operational costs as they shift assets to new regions.

On the other hand, tariffs can create new opportunities. When tariffs encourage the reshoring of foreign goods or the bringing of manufacturing back to the USA, it can lead to long-term growth in domestic freight lanes. Some analysts suggest that producing goods domestically could generate up to 400 truckloads for every one truckload of imported goods.

Cross-Border Lane Dynamics

As mentioned, cross-border truck freight took a nearly 5% hit in May 2025. Landline.media noted that most of that decline came from Canada (down 14.5%), while lanes from Mexico actually grew slightly due to strong shipments of computer-related goods. The oversupply in the USA to the Mexican market continues to push the rates down and shift demand toward U.S. domestic lanes.

Specific tariffs are already reshaping lane decisions. The 35% tariff on some Canadian goods is forcing companies to reassess their strategies. A 17% U.S. tariff on fresh tomatoes from Mexico has cross-border growers worried about logistics costs, potentially causing them to pivot to domestic production.

Managing Uncertainty: Strategies for Success

While you can’t control the trucking industry tariffs themselves, you can control how your business responds. Both carriers and shippers have strategic moves they can make to navigate these choppy waters.

For Trucking Companies and Carriers

In this environment, agility is key. Companies that invest in real-time tracking, predictive analytics, and flexible logistics solutions can respond quickly to market shifts. It’s also a time to focus on efficiency and cost control. Optimizing asset utilization, reducing waste, and monitoring costs closely will be critical. Finally, strong relationships matter more than ever. Acting as a true partner to your clients by communicating openly about tariff impacts can set you apart.

For Shippers and Importers

If you are a shipper, staying informed is your best defense. Monitor official tariff announcements and keep the lines of communication with your transportation providers wide open. Building a resilient supply chain means preparing for disruptions. You can do this by diversifying your suppliers and, just as importantly, focusing on effective inventory management. Proper management of your inventory buffers is your best defense against supply chain volatility.

Tools like customs bonded warehouses and foreign trade zones can also help you defer duty payments and manage cash flow effectively.

Future Outlook for 2025 and Beyond

What does the road ahead look like, and what will be the impact of tariffs on the US trucking industry in 2025 and beyond? Most analysts expect a modest improvement in freight markets by early 2026, but they warn of significant risks from trade policy. Better rates are possible if tariff threats subside and domestic demand gets stronger.

In these uncertain times, having a reliable logistics partner is more critical than ever. ET Motor Freight specializes in creating resilient supply chains that can adapt to policy shifts and market volatility. If you’re ready to secure your freight strategy for the road ahead, contact our team of experts today.

Frequently Asked Questions

1. How will tariffs affect the trucking industry?

Tariffs affect the trucking industry in four main ways: they drive up the cost of trucks and replacement parts, which pushes freight rates higher for customers. They also cause volatile shifts in shipping volumes due to “front-loading,” and require carriers to continually reassess and adjust their freight lanes in response.

2. Will tariffs affect the trucking industry?

Yes, significantly. Even the threat of new tariffs creates market volatility. They directly raise operating costs and shrink profit margins for carriers, especially in cross-border markets. The entire industry faces higher costs, unpredictable demand, and a critical need to become more agile to survive the uncertainty.